With everything going on the world, you may be wondering how this will affect real estate here at home in Canada. We look at the trends happening right now and how it will impact us:

1. Strong U.S Dollar May Be Positive for Canada

The strength of the U.S dollar could benefit Canadian Real Estate in markets, especially in Eastern Canada. There is sentiment that Toronto-area industrial development, especially distribution centers, may be boosted by the U.S. dollar. In the office sector, American firms may see a huge benefit in hiring skilled Canadian staff to cut on costs.

2. Lower Oil Prices – Mixed Impact

In Alberta, there is no large real estate purchases or sales taking place right now. With the ups and downs, it seems that companies are holding with their real estate.

Other places in Canada would see a benefit as non-energy exports become more competitive. Savings at the gas pumps could boost business and consumer spending which would have a positive impact on retailers. This could drive activity in industrial, office and commercial real estate.

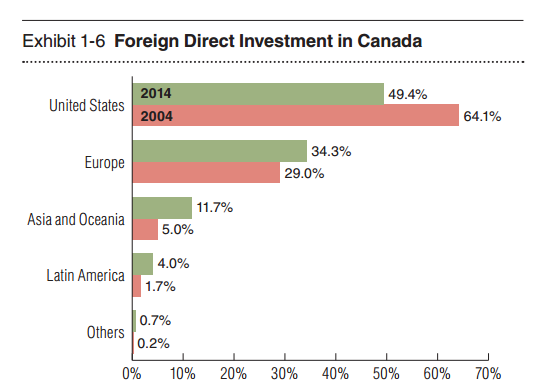

3. Foreign Investment Continues

Global investors continue to see Canada as a safe place for their capital and the lower Canadian dollar makes it even appealing. Foreign investment continues in the traditional markets of Toronto & Vancouver. Interest in office & hotel are increasing as investors look for a good return on their investment.

Other markets such as Saskatoon expect to see an increase in foreign investment where interest in farmland & development land is increasing.

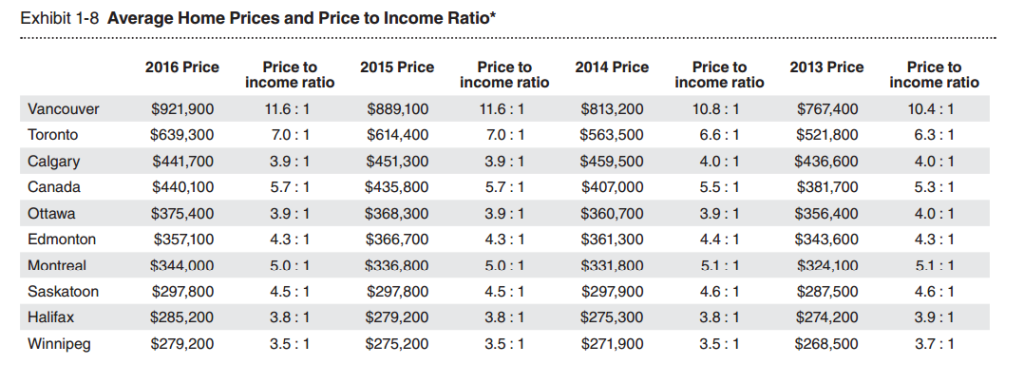

4. Housing Affordability Concerns Increase

While developers are building condominiums and stacked townhouses to meet urban density demands, it is becoming more difficult to build affordable housing in urban centres.

A few factors are pushing housing prices up which include increasing land prices, provincial government policies, lengthy approval processes, increasing construction costs and limited supply.

5. Rise of the Renters

As housing affordability becomes more of an issue, people are choosing to rent. This trend is expected to continue and create new opportunities. Renting is no longer viewed as a temporary stage before home ownership, it is seen as an alternative.

Another reason for the rise of renters is baby boomers who are choosing to cash in and sell their home to move into a luxury rental in the urban center. Luxury rentals offer more cash for spending, flexibility and low maintenance during retirement years.